where to find betterment tax documents

Scroll down to the Tax. Purchase and sales invoices.

State postal code in which the interest was earned should be entered for Betterment Securities.

. Compare - Message - Hire - Done. Alternatively you can work with an HR Block tax professional without visiting a store by paying for the online tax professional service which allows you to upload your tax. The APTC can help make your healthcare premiums more affordable with an average credit amount of 3986.

Your household income for the year has to be between 100. You Can Do It. If more than one state.

Real estate closing statements. Form 5329-T refers to Federal form 5329 for the Taxpayer. Your Form 1040 or 1040-SR any schedules and any other additional forms you have to fill out for your particular.

Start crossing things off your list today. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. When filing your tax return you may be required to report foreign-sourced income which means youll need to report the total of all the foreign-sourced dividend income that you.

Include all necessary tax forms for the IRS if you file by mail. View andor Save Documents. SPDRS Tax Exempt Interest by State.

Submit the documentation. Canceled checks or other documents that identify payee amount and proof of paymentelectronic funds. The amount you paid for that health coverage.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Link your online bank accounts and tax. Additional fees apply for e-filing.

They should check the box for the calendar year or enter. Nationwide Municipal Bond ETFs. You will receive a Form.

The total number of months you had health coverage during the year. Generally the US. Choose your bank or brokerage from the list to import your 1099-DIV and select Continue or manually enter your 1099-DIV by selecting Ill type it in myself.

With Betterment you can automatically import your tax information into HR Block. Upload your documents 247 instead of faxing or mailing them. Go to the Document tab.

However any contributions will be reported on the Form 5498. Schedule B -- Form 1099-DIV Betterment Securities. Get Your Max Refund Today.

The soonest you can start importing is Feb. Government interest portion of a fund dividend income is exempt from state and local income taxes. You can find it on.

Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. If you and your dependents had qualifying health coverage for all of 2021. Form 1095-A gives you two important pieces of information.

IShares Tax-Exempt Interest by State. However there are some states NY CT and CA. Here are Sallys itemized deductions for 2020.

Ad Post Details Of Your Tax Preparation Requirements In Moments Completely Free. It is the customers responsibility to determine the appropriate taxable portion when filing their tax return by completing the Form 8606. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The bank provided Form 1098 which listed the 7280 in loan interest. When saving a file be sure to use Save. PDF files can be viewed and saved using Adobe Reader software.

Down the left side of the screen click on Federal. Review the enclosed Form 886-H-EIC Documents You Need to Send to Claim the Earned Income Credit on theBasis of a Qualifying Child or Children for Tax Year. To view a file click on the hyperlink.

Check the Full-year coverage box on your federal income tax form. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. E-sign most forms instead of printing signing and then scanning.

If you need your tax forms you can download them in. State and local taxes. Last day to file your 2021 taxes with an extension.

Ad Thumbtack - find a trusted Accountant in minutes. This is also the deadline. Complete your tax return.

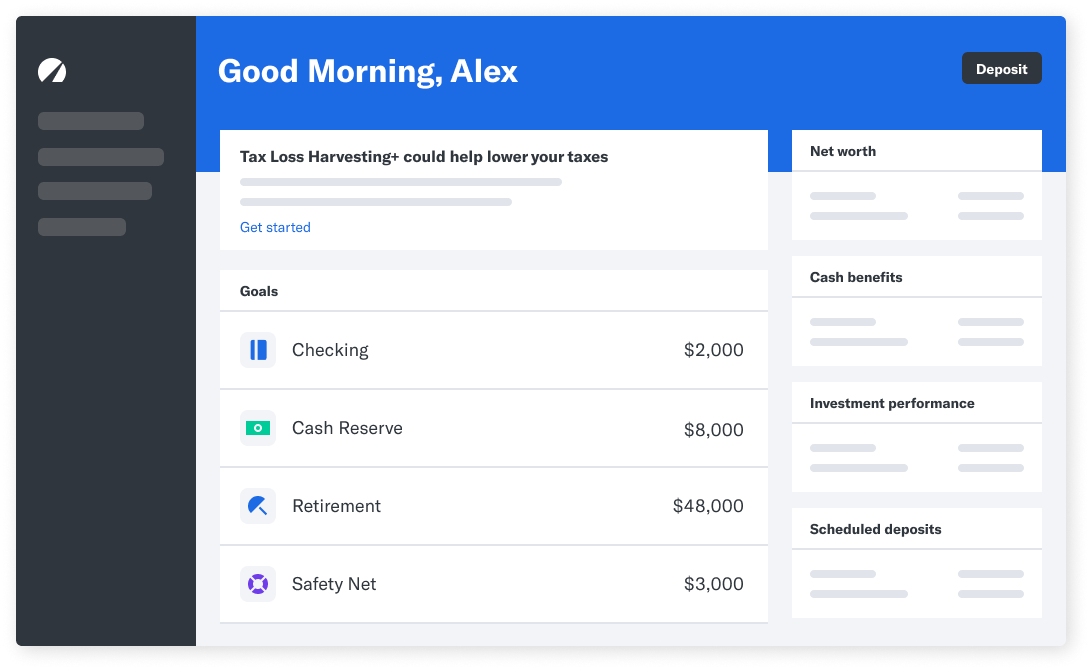

This form is reported directly to the IRS by Betterment and will be uploaded to your account for reference. Free price estimates for Accountants. Your tax documents can be found on the Documents page which is accessed from the top menu of your account.

Watch this video to understand which forms you. 100s of Top Rated Local Professionals Waiting to Help You Today. Across the top of the screen click on Other tax situations.

Taxpayers must file a Form 1040-X for each tax year and mail each years form in a separate envelope to avoid confusion. We cannot make changes to Box 2a of the 1099-R. 17 is the deadline for individuals to file their taxes if they filed for an extension.

Betterment Checking And Cash Reserve Review 2021

Betterment Acquires Wealthsimple S U S Investment Advisory Book Of Business

Retirement Advice Retirement Calculator Investing For Retirement

Tax Smart Investing With Betterment

Services Provided By A Title Company Title Insurance Title Property Tax

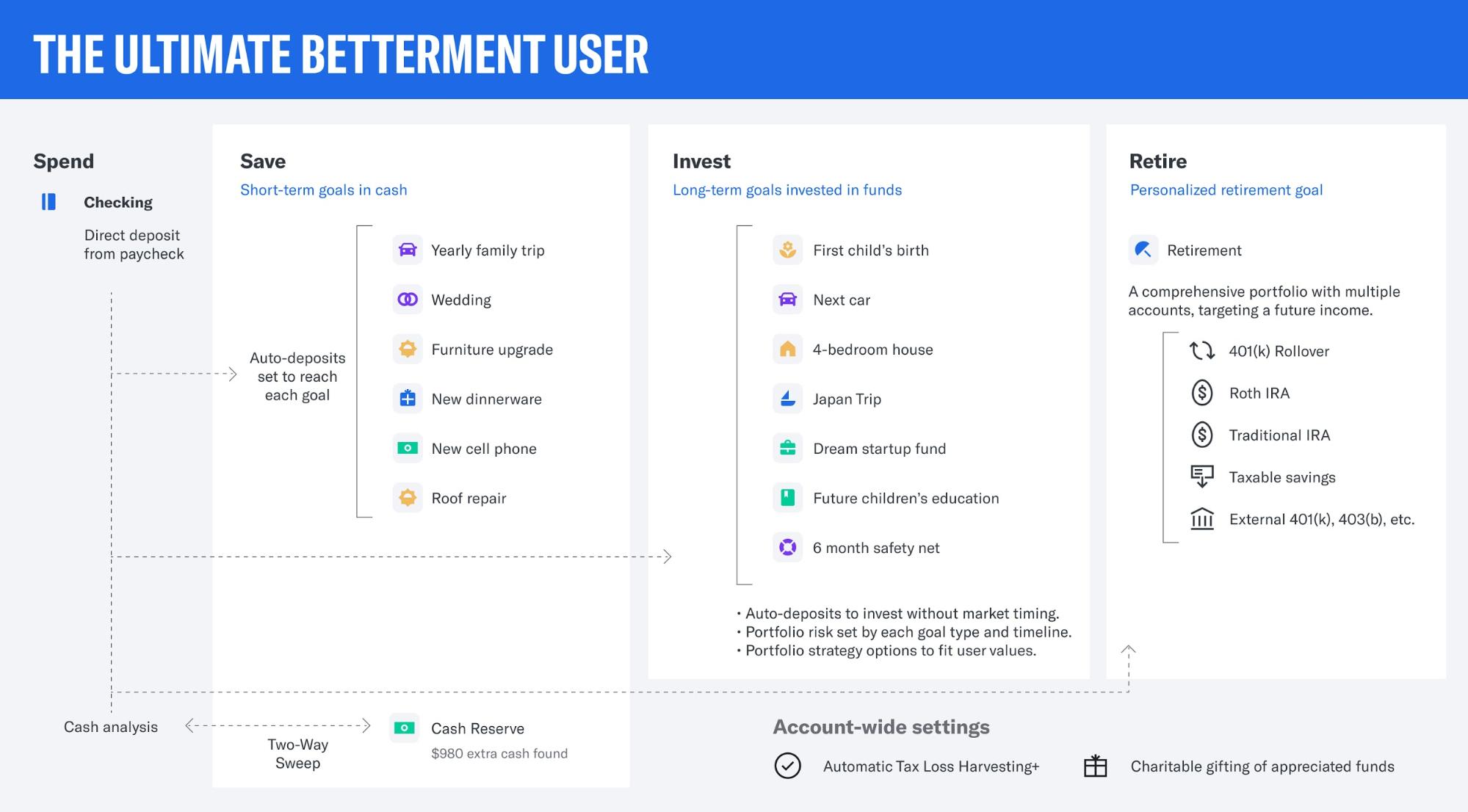

What The Ultimate Betterment User Looks Like

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

A Beginner Investors Guide To Vanguard And Betterment Two Quality Low Cost Investment Providers So You Can Deter Investing Money Finance Investing Investing

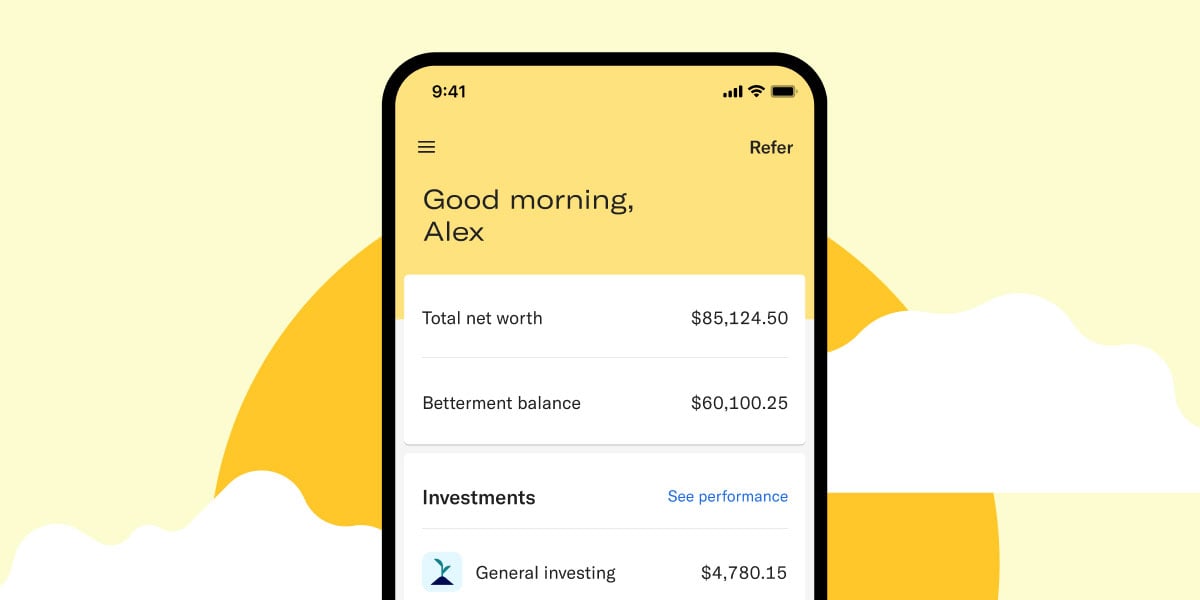

How To Start Investing With Betterment Investing Start Investing Robo Advisors

Your 2015 Tax Season Calendar Tax Season Season Calendar Tax Help

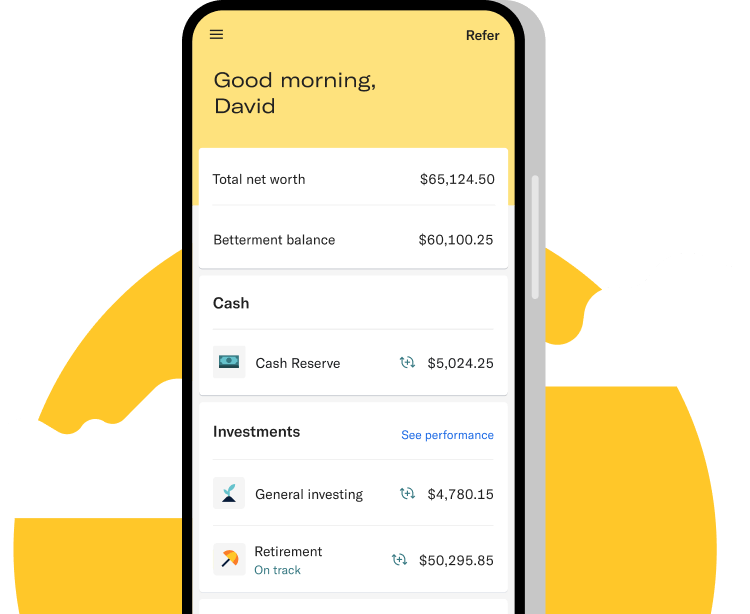

Betterment Mobile App Investing On The Go

Betterment Checking And Betterment Cash Reserve Review Cash Management Certificate Of Deposit Best Ira Accounts

Betterment Review Smartasset Com

Betterment Retirement Income Retirement Retirement Advice

6 Tax Strategies That Will Have You Planning Ahead

Do You Know Did You Know Real Estate Investing How To Plan

Itr Refund Have You Pre Validated Your Bank Account Step By Step Guide To Do Tax Refund Income Tax Return Accounting

Betterment Sophisticated Online Financial Advice And Investment Management Investing Financial Advice Finance